Alright, all you Market Mavericks, Crypto explorers, and tech-savvy traders hunting for smarter analytical tools! Today, we’re dissecting what’s hailed as “Moving Average 2.0,” an intelligent indicator – the McGinley Dynamic (MD)! If you find SMA too slow, EMA not smooth enough, or HMA too twitchy, then MD might just be the secret weapon you’ve been searching for! It knows how to automatically adjust its own speed to try and keep pace with the market rhythm! Sounds like it’s got some AI vibes, right? Let’s Go!

What the heck is McGinley Dynamic (MD)? How is it “Dynamic”?

The MD indicator was introduced in the 1990s by John R. McGinley, a Chartered Market Technician (CMT) heavyweight. Like Alan Hull (HMA inventor), he wanted to tackle the core pain points of traditional moving averages:

- Lag: The market moves, then the MA slowly catches up.

- Whipsaws (False Signals): Using short-period MAs for speed leads to getting slapped around in choppy markets.

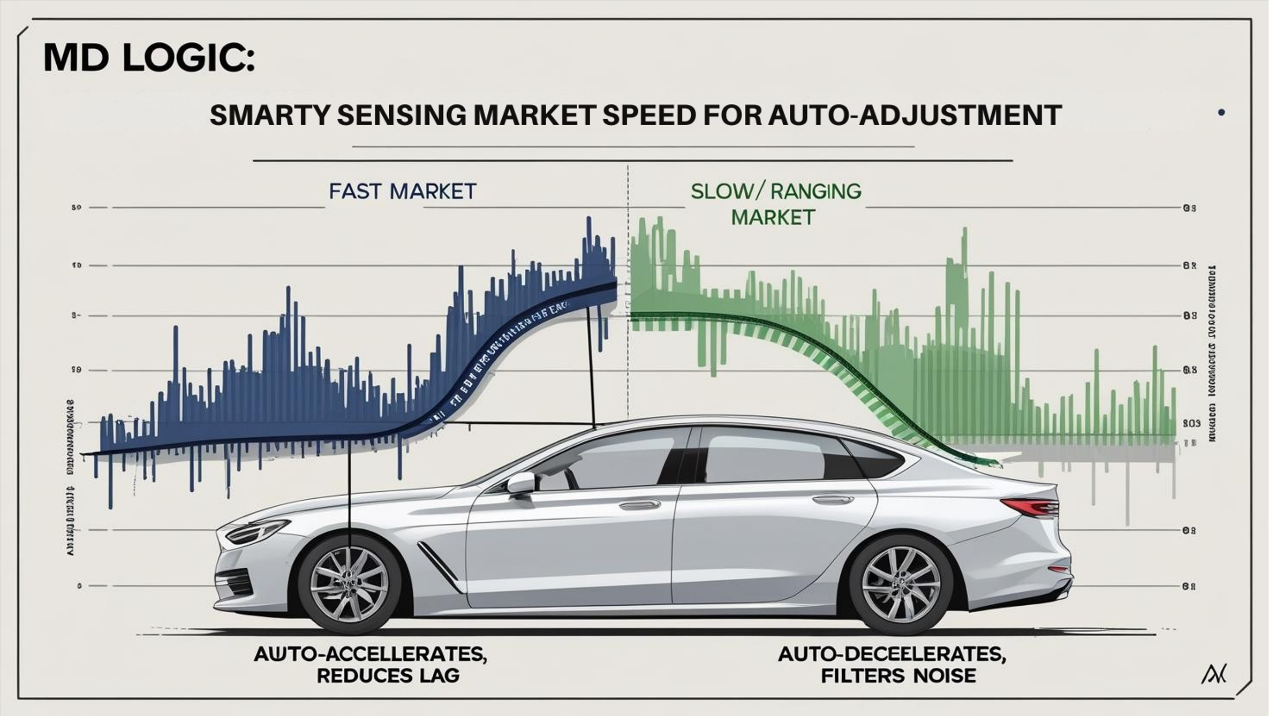

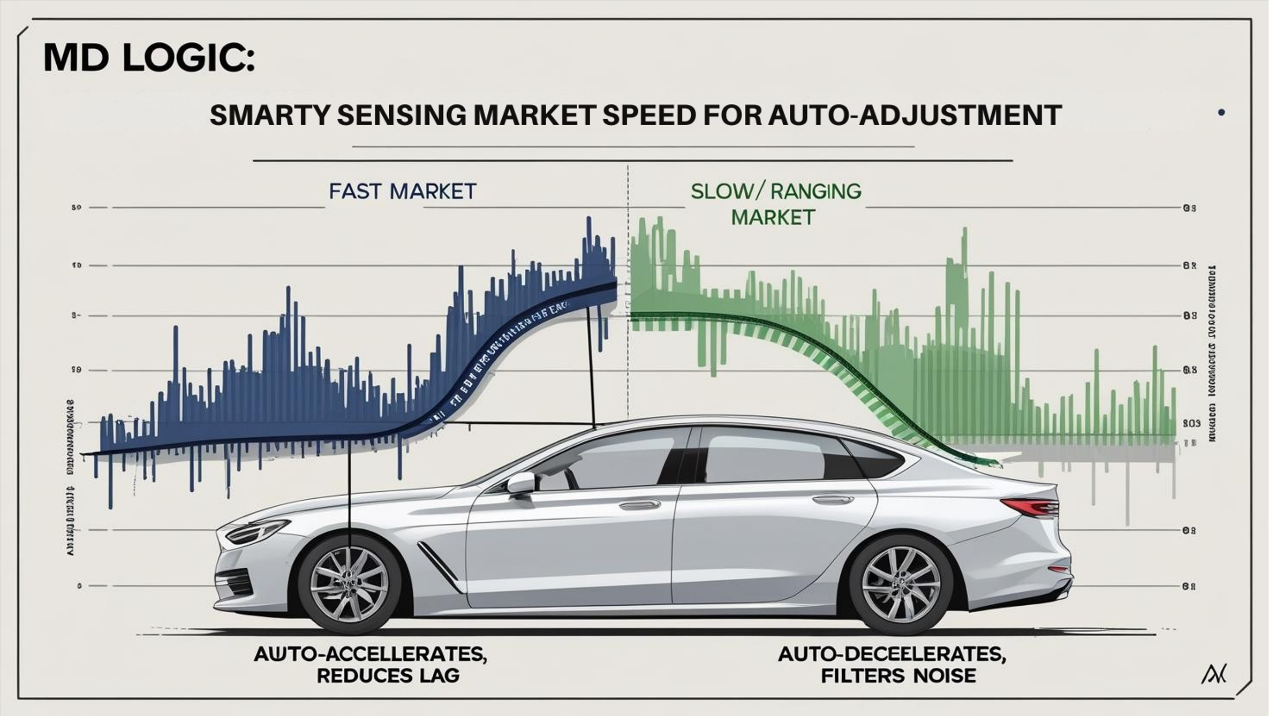

McGinley observed that traditional MAs use a fixed period, but the market’s speed changes constantly! How can the same MA keep up effectively during a fast bull run versus a slow bear market decline?

So, the core “Dynamic” aspect of MD is this: its smoothing speed isn’t fixed; it automatically adjusts based on the market’s own velocity!

- When the market moves fast (high volatility, strong trend) → MD automatically speeds up, hugging price closer, reducing lag.

- When the market moves slow (low volatility, consolidation) → MD automatically slows down, becoming smoother, reducing false signals.

「McGinley Dynamic: The Auto-Adjusting Smart MA」

MD’s Design: How Does Auto-Speed Work? (Decoding the Magic)

MD’s calculation formula looks a bit intimidating, but the key lies in a clever factor:

MD = MD[1] + ( Price – MD[1] ) / ( N * (Price / MD[1])^4 )

- MD = Today’s McGinley Dynamic value

- MD[1] = Yesterday’s McGinley Dynamic value

- Price = Current price

- N = The MA period you set (similar to traditional MA Period)

- The Core Magic: ( Price / MD[1] )^4 This part!

- This is the ratio of the current price to yesterday’s MD value, raised to the power of 4.

- Think about it:

- If the price moves far away from the MD line (Price / MD[1] ratio deviates significantly from 1), raising this ratio to the 4th power massively amplifies this deviation.

- This amplified ratio then adjusts the denominator N * (Ratio)^4. The key is the relationship between the difference (Price – MD[1]) and this adjusted denominator. McGinley designed it so that when price accelerates away from MD, the MD catches up faster. When price is close to MD or moving slowly, the MD becomes smoother.

- The power of 4 was empirically chosen by McGinley as effective in minimizing separation and improving “hugging” of the price.

Simply Put: MD has a built-in “sensor” that detects how fast the price is moving (relative to the line itself) and automatically adjusts its own “throttle” (smoothing/responsiveness). It’s like your car’s Adaptive Cruise Control – speed up when the road is clear, slow down when there’s traffic, maintaining an intelligent distance.

「MD Logic: Smartly Sensing Market Speed for Auto-Adjustment」

MD Basic Plays (Beginner’s Guide):

Because of MD’s smart features, its basic usage is often more reliable than traditional MAs, but still shouldn’t be used in isolation.

- Superior Trend Line:

- MD sloping UP, price above it → Strong bullish bias.

- MD sloping DOWN, price below it → Strong bearish bias.

- It arguably reflects the true dynamic trend better than SMA/EMA.

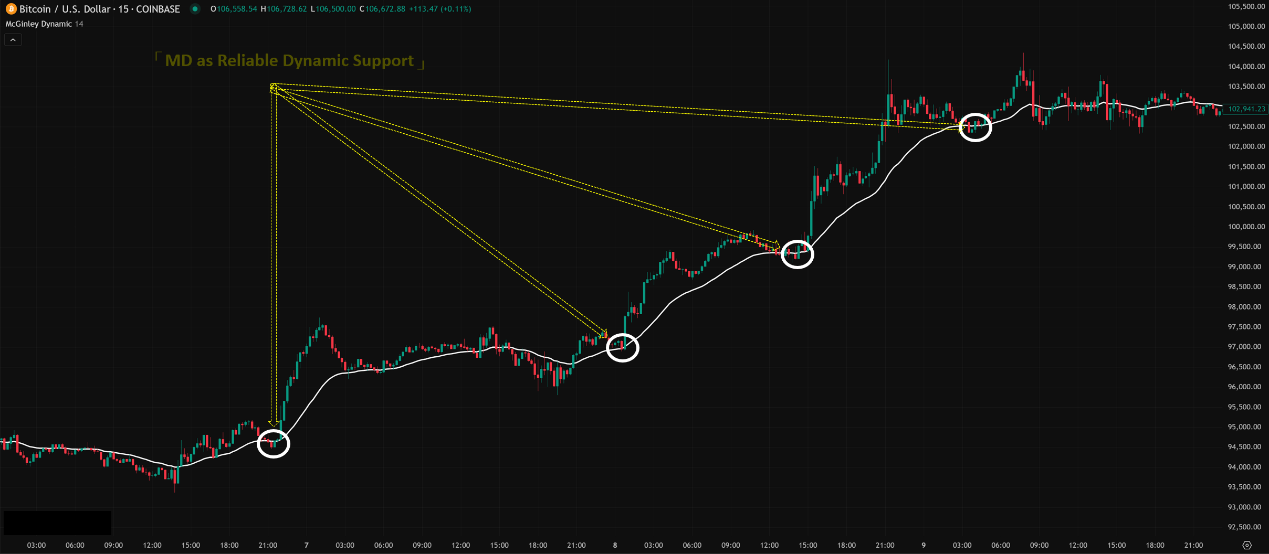

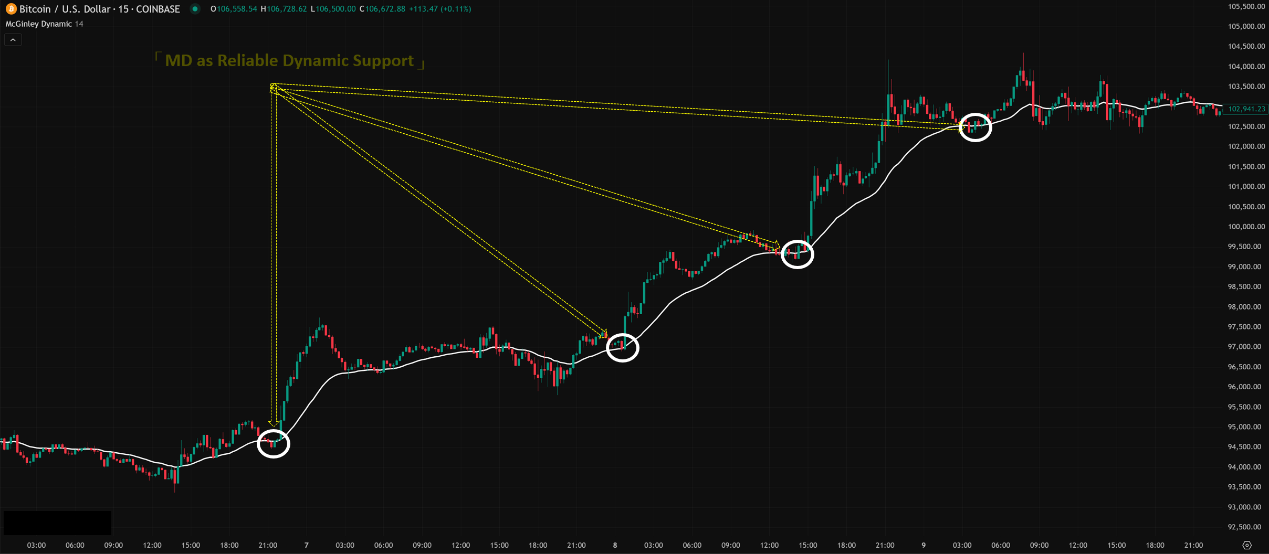

- Highly Reliable Dynamic Support & Resistance (S/R):

- This is one of MD’s strongest applications! Because it auto-adjusts, it’s less prone to false breakouts than traditional MAs when used as S/R.

- Uptrend: Price pulling back to the rising MD line is a High-Quality Potential Buy Zone.

- Downtrend: Price rallying to the falling MD line is a High-Quality Potential Short Zone.

- Many traders use the MD line directly as an entry reference point.

「McGinley Dynamic’s Core Use: Reliable S/R」

3. Slope Change as Early Warning:

-

- Due to its responsiveness and smoothness, a change in MD’s slope (from positive to negative, or vice versa) can serve as an earlier and more reliable warning of a potential trend change than traditional MAs.

- But again, don’t trade this alone! It’s just an alert, needing other confirmation.

- Crossovers? (Less Common): While you can plot fast/slow MDs, the core strength of MD isn’t in crossovers but its reliability as a single trendline/S&R. Crossover strategies using MD are less common.

MD Advanced Plays & Parameter/Timeframe Breakdown (Pro Strategies):

Core Parameter: Period (N)

- MD’s main parameter is N. It’s conceptually a bit different from traditional MA periods. McGinley himself stated his formula makes MD(N) react roughly as fast as an EMA(N/2)! For example, MD(20) might feel closer in speed to an EMA(10).

- Default Parameters: No absolute standard, but McGinley mentioned 14 as a good starting point in his work. Many platforms might default to 10 or 14.

- Impact of Changing N:

- Smaller N (e.g., 10): MD is faster, hugs price tighter.

- Larger N (e.g., 20, 50): MD is smoother, slightly further from price (but still closer than same-N EMA/SMA).

- Key Insight: Because MD auto-adjusts, changing N affects its responsiveness less dramatically than changing EMA/SMA periods. Both MD(10) and MD(20) will try to track price closely; the main difference is smoothness. This is an advantage, making parameter selection relatively less sensitive.

Parameter Settings Analysis & “Hottest” Combo Discussion:

- “Hottest” Parameter? Probably Near the Default!

- Since MD is less sensitive to N, many find values between 10 and 20 (e.g., 14, 16, 20, 21) work well.

- There’s less need to hunt for “unique” parameters. McGinley’s design is inherently robust.

- How to Choose?

- Consider Your Style:

- Short-Term/Day Traders (H1/M15): Might use around 10-14 for a faster S/R reference.

- Swing Traders (H4/Daily): Might use around 14-21 to balance responsiveness and smoothness.

- Long-Term Traders (Weekly): Might use 21 or longer (e.g., 50), understanding it will still be faster than EMA of the same N.

- Most Important: Visual Confirmation! Add different MD periods to your chart. See which period N creates a line that visually acts as the most reliable S/R for your market and timeframe (i.e., which line does price respect best on pullbacks/rallies?).

- Conclusion: No “hottest” combo, but 14 is a great start. Focus on understanding MD’s behavior and finding an N value that looks right and reliable through visual inspection and simple testing.

「MD Parameters: N Less Critical, Smart Adjustment is Core」

Timeframe Analysis:

- Ultra Short-Term (M1, M5):

- Still Challenging, but Potentially Better Than Other MAs. MD’s smoothness can filter some extreme M1/M5 noise, while its responsiveness prevents excessive lag.

- But Risk: Randomness is high on these timeframes. MD’s S/R might be frequently tested or fail. Still needs strong confirmation.

- Conclusion: If you absolutely must use an MA-type indicator on M1/M5, MD might be one of the less terrible choices, but definitely not for beginners.

- Intraday / Short Swing (M15, H1, H4):

- MD’s Golden Zone! These timeframes start showing clearer intraday or short-swing trends and pullbacks, where MD’s strength as reliable dynamic S/R shines brightest.

- How to Use:

- Primarily use MD (e.g., 14 or 21) as dynamic S/R. Wait for price to test the MD line and show a confirmation candle (Pin Bar, Engulfing, etc.) before entering.

- Monitor the MD slope for short-term trend strength.

「MD on H1/H4 Charts: The Sweet Spot」

- Swing / Long-Term (Daily, Weekly):

- Still Performs Excellently! MD can provide a very smooth long-term trendline that is simultaneously closer to price and faster reacting than EMA/SMA.

- How to Use:

- Use MD (e.g., 21 or 50) for major trend direction.

- As a key reference level for adding to positions with the trend (price pulls back to rising MD).

- MD turns can provide earlier warnings of potential long-term trend shifts.

Summary: Which Unique Parameter Combo + Timeframe is Hottest & Most Effective? How to Use It?

- Parameters: Don’t chase “unique.” Start with 10-21 (esp. 14). Visually fine-tune based on your timeframe.

- Timeframe: H1, H4, Daily are the most common battlegrounds. Weekly is also great. M15 or lower needs high skill.

- Hottest / Most Effective Usage = Treat it as the Ultimate Dynamic S/R + Trendline:

- Core Application: Dynamic Support & Resistance! Wait for price to test the MD line and show confirmation before acting.

- Watch Slope Changes as early warnings.

- Don’t rely heavily on crossovers.

- Price Action Confirmation is KING! MD + Pin Bar / Engulfing @ S/R = High-probability setup.

- Can combine with other indicators for confluence (e.g., RSI for pullback depth, ADX for trend strength).

McGinley Dynamic: The “Intelligent Evolution” of Moving Averages

MD is genuinely a significant improvement over traditional MAs, attempting to solve the dilemma between lag and smoothness. Its advantages:

- Auto-Adjusts Speed to market conditions.

- Significantly Less Lag than SMA/EMA.

- Very Smooth Line, filters noise well.

- Highly Reliable as Dynamic S/R.

Its potential drawbacks:

- Calculation is More Complex (though you don’t compute it manually).

- Still Has Some Lag (just much improved).

- Not a Standalone Trading System, needs combination with other analysis.

- Less Famous than EMA/SMA, perhaps less “self-fulfilling prophecy” effect.

「The Moving Average Evolution: MD’s Intelligent Upgrade」

If you’re tired of the sluggishness or false signals of traditional MAs, the McGinley Dynamic is absolutely worth your time to investigate and test. It might genuinely improve the precision of your trend trading and S/R analysis.

Next Steps:

- Add the McGinley Dynamic indicator to your platform (note the period N).

- Try the 14-period setting on your favorite H1, H4, and Daily charts.

- Focus on how price interacts with the MD line, especially on pullbacks/rallies.

- Compare MD’s responsiveness and smoothness against an EMA(N/2) (e.g., MD(14) vs. EMA(7)).

- Backtest! Test strategies using MD as dynamic S/R and see how they perform.

Hope you master this smart weapon and level up your trading game!🧠💡📈🚀