Okay, all you market hunters, Crypto explorers, and sharp traders looking to just chill until the real trend shows up! Today, we’re dissecting a super unique indicator with a wild personality, using an animal analogy – the Alligator indicator! Yep, the one with the “Jaw,” “Teeth,” and “Lips”! Don’t think it’s just messing around; this alligator was designed by a true master to help you spot the market’s “feeding” time and, most importantly, to tell you to sit tight and do nothing when it’s “sleeping”!

What the heck is the Alligator? Why should you care about this “reptile”?

The Alligator indicator was invented by the legendary trader and Chaos Theory guru Bill Williams (Yes, the same genius behind Fractals, AO, AC!). He believed the market is actually trendless most of the time (the Alligator is sleeping) and only trends a small portion of the time (the Alligator wakes up to hunt/eat). The core purpose of the Alligator indicator is to help you identify these market states:

- Alligator Sleeping: Trend is unclear, ranging market.

- Alligator Awake / Eating: A trend is emerging!

It’s composed of three Smoothed Moving Averages, but what makes them special is that they are all shifted forward in time!

- Alligator’s Jaw: Blue line. The slowest line, calculated using a 13-period SMA, then shifted forward by 8 bars. Represents the market’s long-term balance point / major trend.

- Alligator’s Teeth: Red line. The middle-speed line, using an 8-period SMA, shifted forward by 5 bars. Represents the market’s mid-term balance point / secondary trend.

- Alligator’s Lips: Green line. The fastest line, using a 5-period SMA, shifted forward by 3 bars. Represents the market’s short-term balance point / immediate momentum.

「Alligator Indicator Structure: Jaw, Teeth, Lips (Shifted Forward)」

Why shift them forward? Bill Williams believed these balance lines represent where the market “should” be, and projecting them forward helps visualize the relationship between current price and these future equilibrium points.

Alligator’s Origin Story & Design: Chaos Theory and Market Rhythm

Bill Williams wasn’t your average technical analyst; he was heavily influenced by Chaos Theory, fractal geometry, and other non-linear sciences. He believed the market isn’t just random but has its own complex structure and rhythm.

- Design Philosophy: Mimicking an Alligator’s Behavior

- Sleeping: When the three lines are intertwined and close together, it’s like the alligator’s mouth is shut, sleeping. This indicates a directionless, ranging market. Bill Williams strongly emphasized: “When the Alligator sleeps, don’t disturb it! (Stay out of the market!)” This is one of the Alligator’s most crucial functions – helping you avoid getting chopped up in garbage sideways markets!

- Awake / Eating: When the three lines start to separate and spread out (fanning out), roughly parallel, it’s like the alligator opening its mouth to eat. This signals a trend is starting to form!

- Eating Up: Green line > Red line > Blue line, and lines are spreading upwards → Uptrend.

- Eating Down: Blue line > Red line > Green line, and lines are spreading downwards → Downtrend.

- Why Periods 5, 8, 13? These are Fibonacci Numbers! Bill Williams believed these numbers relate to natural rhythms found in nature, including markets.

- Why Shifts of 3, 5, 8? Also Fibonacci numbers! He felt these specific shifts best represented the balance points across different timeframes.

「Alligator Market States: Sleeping vs. Eating」

Alligator Basic Plays (Beginner’s Guide to Reading the Chart):

- Identifying Market State:

- Lines tangled → Sleeping → Stay out, do nothing!

- Lines separated & fanning out → Eating → Trend forming, get ready to look for opportunities!

- Determining Trend Direction:

- Eating Up: Green line on top, Red middle, Blue bottom → Uptrend.

- Eating Down: Blue line on top, Red middle, Green bottom → Downtrend.

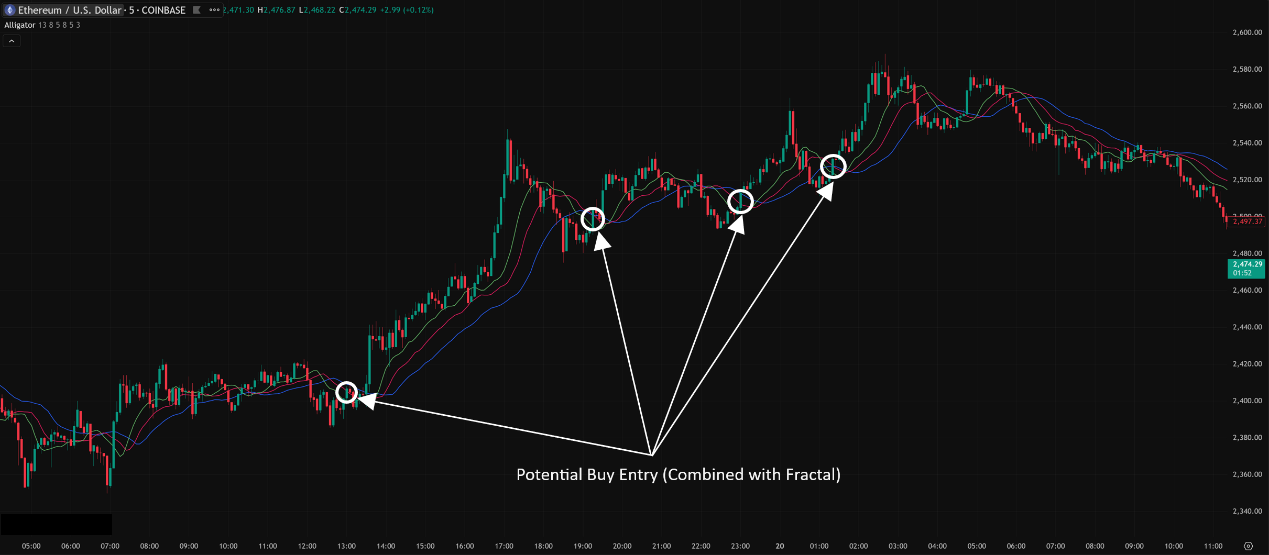

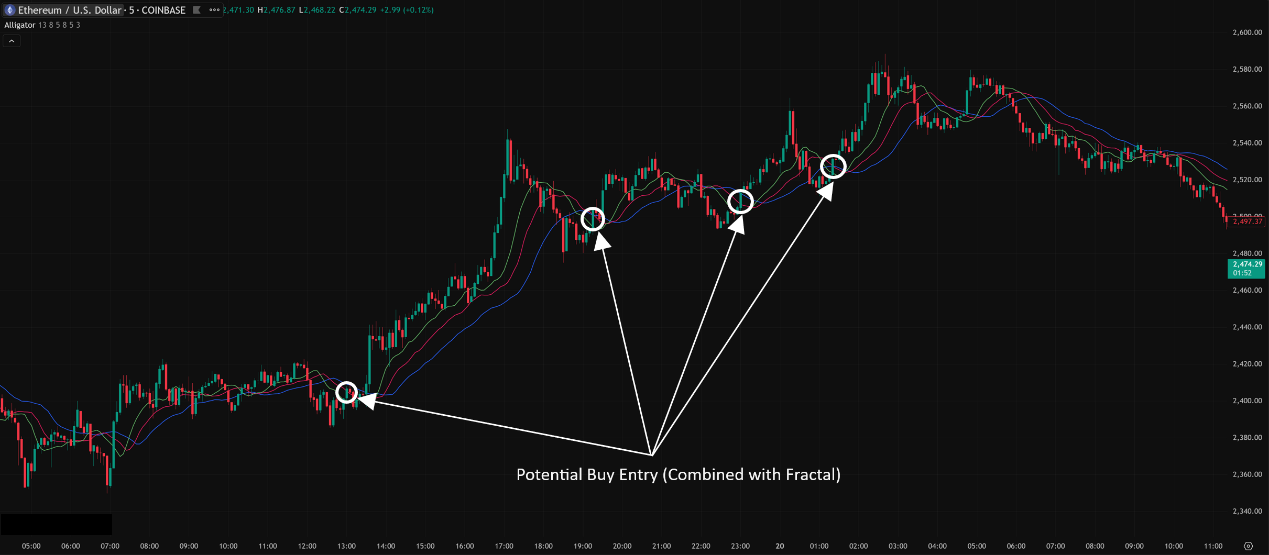

- Entry Signals (Usually Combined with Other Tools):

- The Alligator itself is NOT the primary entry signal generator! It mainly confirms the trend and filters out ranges.

- Bill Williams’ system typically combines it with Fractals:

- After the Alligator starts Eating Up, wait for price to break above the first Up Fractal that forms above the Alligator’s Lips → Consider Buying.

- After the Alligator starts Eating Down, wait for price to break below the first Down Fractal that forms below the Alligator’s Lips → Consider Selling/Shorting.

- Crucial: Any breakout that occurs while the Alligator is sleeping is a false signal!

「Alligator + Fractals Entry Strategy」

4. Exit / Stop Loss Reference:

-

- Method 1 (More Common):

- Long Position: Consider closing when price closes below the red Teeth line.

- Short Position: Consider closing when price closes above the red Teeth line.

- Method 2 (More Conservative): Exit when the three lines start tangling up again (Alligator goes back to sleep).

- Stop Loss: Initial stop can be placed on the other side of the entry candle or at a recent Fractal point. The red Teeth line can be used as a trailing stop reference.

Alligator Advanced Plays & Parameter/Timeframe Breakdown (Master Class):

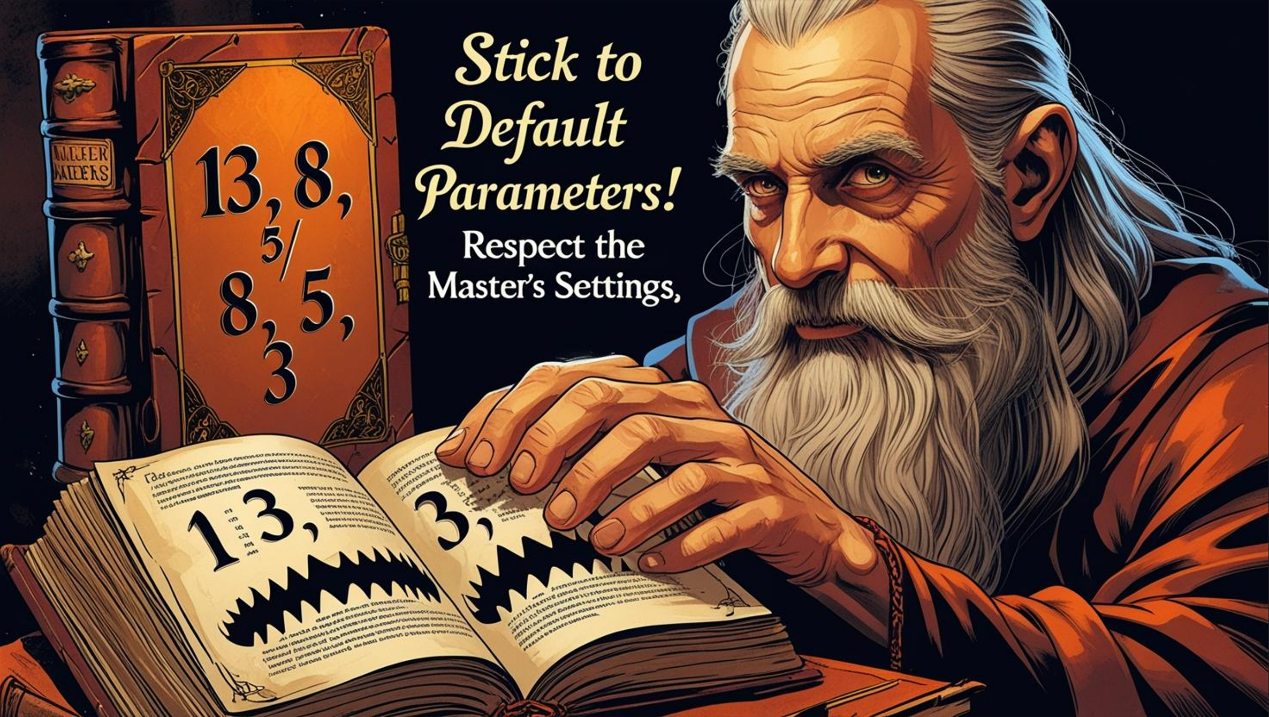

Parameter Settings: The Sacred Numbers!

- Default Parameters: (13, 8, 5) for Periods / (8, 5, 3) for Shifts

- Why NOT Change Them?

- Bill Williams’ Philosophy: He believed this specific set, based on Fibonacci numbers, was key to capturing the market’s natural rhythm and integral to the entire system. Changing them means it’s not truly “Alligator.”

- System Integrity: Alligator is often used with his other indicators (Fractals, AO, AC, Gator Oscillator), and their interactions are designed around the default settings.

- Global Consensus: The vast majority of traders using the Alligator use the defaults. Changing them means you’re seeing something different from the crowd, potentially losing the indicator’s “consensus” value.

- Change for Crypto / 24-Hour Markets?

- Similar to the Ichimoku debate, some question if parameters based on older market structures apply to 24/7 markets.

- However, followers of Bill Williams argue that the market’s chaos/fractal structure is universal, and the parameters shouldn’t be changed.

- Reality Check: It’s extremely rare to find reliable strategies demonstrating better performance with altered Alligator parameters. Changing them often means you might not fully grasp the indicator’s intended philosophy and usage.

- Bottom Line: The “hottest” parameter combo IS the default! (13, 8, 5 / 8, 5, 3). Spend your time mastering its interpretation and combination with other tools, not tweaking parameters.

「Alligator Parameters: Respect the Master’s Settings」

Timeframe Analysis:

- Ultra Short-Term (M1, M5, M15):

- Extremely Noisy, Very Difficult to Use! The Alligator will constantly “fake sleep” and “fake wake,” with lines crossing and tangling frequently. It’s hard to distinguish real trends from chop. Fractal breakout signals will be overwhelming.

- Conclusion: Unless you’re doing high-frequency trading with a very specific strategy, the Alligator’s reliability is very low on these timeframes.

- Intraday / Short Swing (H1, H4):

- Starts becoming meaningful. H1 might still be a bit choppy, but H4 is a decent timeframe for observation.

- How to Use:

- Identify H4-level ranging zones (sleeping) to avoid trading.

- When the H4 Alligator clearly starts eating, confirming the intraday/short-swing trend, look for entries on shorter timeframes (e.g., M30, H1) using Fractals or other confirming signals.

- The H4 Teeth line (red) can serve as a significant trailing stop reference for swing trades.

「Alligator on 4-Hour Chart: Identifying Swings & Ranges」

- Swing / Long-Term (Daily, Weekly):

- Alligator’s Comfort Zone! Most Reliable Application!

- How to Use:

- Determine the major trend. When the Daily/Weekly Alligator is consistently eating up/down, the main trend is established.

- Catch major swings. After the Daily Alligator wakes up and starts eating, enter on a Fractal breakout and potentially hold for a significant portion of the trend, until the Alligator goes back to sleep or price decisively breaks the Teeth line.

- Filter long-term noise: A sleeping Weekly Alligator might signal months of major consolidation, suggesting lower position sizes or switching to range strategies.

「Alligator on Daily Chart: Capturing Major Trends」

Summary: Which Unique Parameter Combo + Timeframe is Hottest & Most Effective? How to Use It?

- Parameters: No “unique,” just use the default (13, 8, 5 / 8, 5, 3)!

- Timeframe: Daily / Weekly works best and is most representative. H4 is a good secondary. H1 and below see increasing risk.

- Hottest / Most Effective Usage = Bill Williams’ Systematic Trading:

- Core is State Identification: Sleeping or Eating? If sleeping, DON’T TOUCH IT!

- Use Longer Timeframes (Daily/Weekly) for Overall Direction.

- After the Alligator starts Eating, use Shorter Timeframes (Daily/H4) combined with Fractals for Breakout Entries. (e.g., Buy when price breaks Up Fractal above the Lips).

- Can combine with Awesome Oscillator (AO) / Accelerator Oscillator (AC) to gauge momentum (Divergence between AO and price can be a warning).

- Use the Teeth line (Red) as the primary Trailing Stop reference.

Alligator Isn’t Just an Indicator, It’s an Entry Point to a Trading Philosophy!

Bill Williams’ Alligator is the foundation of his broader trading system. Its appeal lies in:

- Visualizing Market States: Sleeping vs. Eating is intuitive.

- Emphasizing Discipline: Forcing you to stay out during chop saves a lot of unnecessary losses.

- Trend is King: Focuses on making money when the trend is clear.

But understand its characteristics:

- Lagging: It’s still based on moving averages.

- Ranges are for Avoidance, Not Trading: It doesn’t tell you how to trade ranges.

- Signals Can Be Late: Waiting for the Alligator to eat and then break a fractal might mean missing the trend’s initial thrust.

- Best Used Within the Full System: Using Alligator alone is less effective than combining it with Fractals, AO, etc.

「Alligator: Your Market State Gatekeeper」

The Alligator indicator is an insightful tool that reminds us the market is often directionless, and patience in waiting for real opportunities is key to success.

Next Steps:

- Add the Alligator (using default parameters!) to your Daily and H4 charts.

- Carefully observe the patterns of lines tangling (sleeping) and spreading (eating).

- Note how price interacts with the three lines (especially the Teeth).

- Start researching Bill Williams’ other indicators, like Fractals and the Awesome Oscillator, to understand how they work together with the Alligator.

- Remember: When the Alligator sleeps, you should rest too!

Hope you learn to dance with the Alligator and catch those big market waves!🐊🌊💰