Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Okay Okay! What’s up, Market Surfers and future Trading Masters! Ready for the next TA weapon unlock? After covering Pivot Points High/Low, today we’re introducing a related but more “standardized,” more “rule-based” indicator specifically designed to mark those short-term turning points – it’s the Fractals indicator, designed by the master himself, Bill Williams!

Yeah, those little upward ▼ and downward ▲ arrows you often see on charts? That’s them! Fractals look simple, but they’re actually a fundamental component of Bill Williams’ Chaos Theory trading methodology. They aren’t direct buy/sell signals themselves, but they help you objectively identify potential short-term tops and bottoms. Think of them as little “flags” planted on your market map, pointing out notable “peaks” and “valleys.”

Wanna know how these “flags” get placed? How to use them to confirm trends? How they work best with other Bill Williams indicators (especially the Alligator!)? Why some traders use them as breakout helpers? Alright! Let’s dive deep into the world of Fractals and decode this simple yet useful little tool! Let’s find the turning points!

The birth of the Fractals indicator is inseparable from Bill Williams’ unique view of the markets.

The Inventor: Bill Williams – Yes, him again! The legendary trader who gave us the Alligator, AO, AC, and BW MFI also created the Fractals indicator. He used Fractals as a basic tool within his “Trading Chaos” method to identify market structure.

Core Philosophy: The Fractal Nature of Markets – Williams believed that market behavior repeats similar patterns across different time scales, much like natural “Fractal” patterns (think coastlines, snowflakes, broccoli ). He felt that short-term price turning points also possess a recognizable basic structure.

Purpose of Fractals: Identifying Short-Term Reversal Points – The design goal of the Fractals indicator is straightforward: to mark short-term highs and lows on the chart that meet specific criteria. These points represent a local top or bottom in price within a short window (usually 5 bars), suggesting that short-term momentum might be shifting.

Not an Independent Predictive Tool: Importantly, Bill Williams emphasized that Fractals themselves are NOT predictive but are lagging confirmation signals. They only tell you “a short-term high/low has just formed here,” not “a high/low will form here.” Their power comes from being used in conjunction with other indicators, especially the Alligator.

So, the Fractals indicator was designed by Bill Williams, based on his fractal market philosophy, as a visual aid to objectively mark short-term price turning points.

The definition of a Fractal is very clear, based on a simple 5-bar pattern rule:

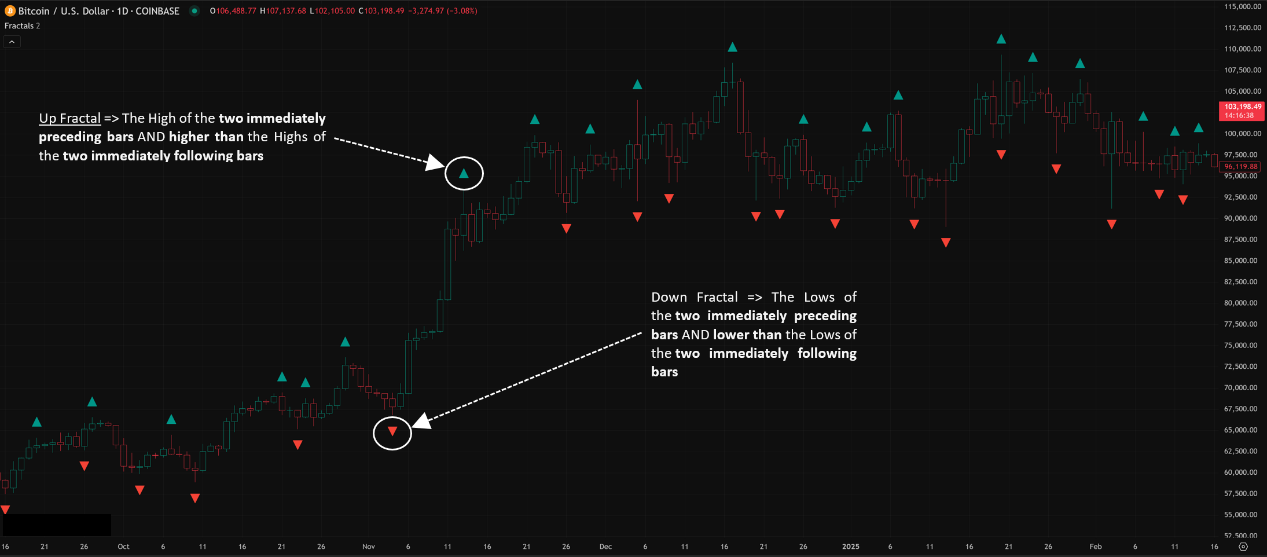

Up Fractal / Bearish Fractal: ▼

Definition: A candle’s High is higher than the Highs of the two immediately preceding bars AND higher than the Highs of the two immediately following bars. An Up Fractal arrow ▼ is then typically plotted above the high of this middle candle.

Appearance: Looks like a small “peak” ⛰️, highest in the middle.

Meaning: Marks a short-term top. Price made a high for that 5-bar period and then failed to exceed it (at least within the next two bars). Suggests short-term upward momentum may have stalled or weakened here.

Down Fractal / Bullish Fractal: ▲

Definition: A candle’s Low is lower than the Lows of the two immediately preceding bars AND lower than the Lows of the two immediately following bars. A Down Fractal arrow ▲ is then typically plotted below the low of this middle candle.

Appearance: Looks like a small “valley” ️, lowest in the middle.

Meaning: Marks a short-term bottom. Price made a low for that 5-bar period and then failed to break lower (at least within the next two bars). Suggests short-term downward momentum may have stalled or weakened here.

Core Points:

Lagging Nature: A Fractal can only be confirmed and displayed after the two bars to its right have fully closed. Therefore, the Fractal arrow you see is actually marking the high/low from two bars ago. This lag is very important!

They Are “Points,” Not S/R Lines: Fractals mark specific high or low points. They aren’t horizontal lines themselves but indicate potential turning “points” or short-term extreme points.

Think of Game Checkpoints:

Fractals are like checkpoints in a video game.

Up Fractal ▼: You reached this point, the highest recently. The next two steps didn’t go higher, so the game plants a flag: “Recent High Checkpoint here.”

Down Fractal ▲: You reached this point, the lowest recently. The next two steps didn’t go lower, so the game plants a flag: “Recent Low Checkpoint here.”

The key is, you only know it was a checkpoint after you’ve already passed it.

「Up Fractal and Down Fractal Formation Explained」

Fractals aren’t really designed for standalone signal generation. Their power comes from combining them with other tools.

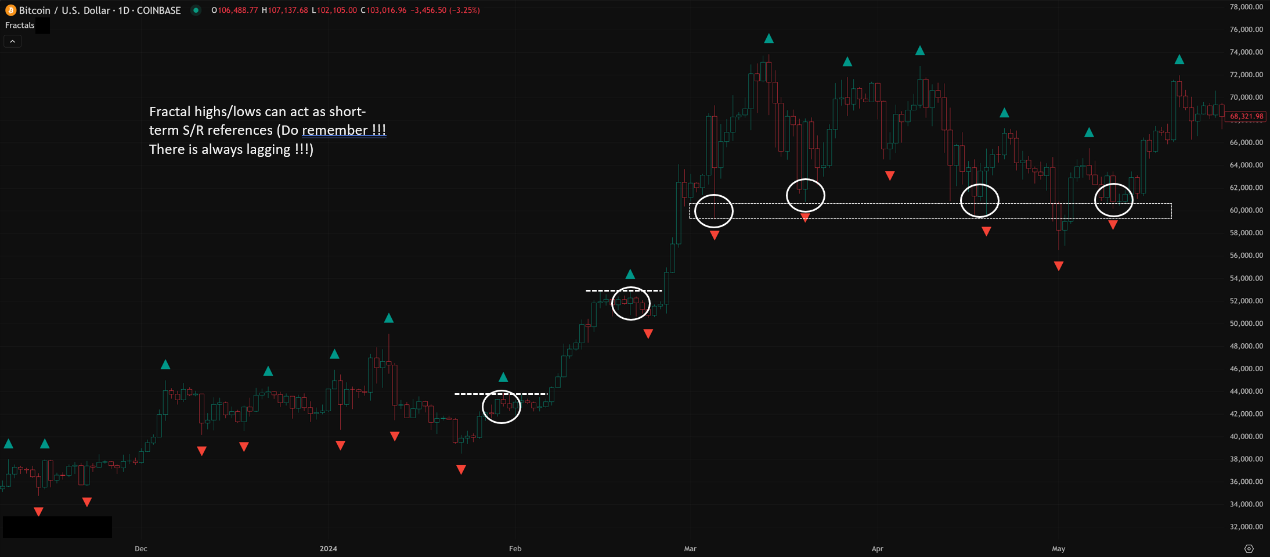

Level 1: Basic Usage – Identifying Short-Term S/R & Structure Points

Marking Potential Short-Term S/R:

The High of each confirmed Up Fractal ▼ can be viewed as a short-term resistance point.

The Low of each confirmed Down Fractal ▲ can be viewed as a short-term support point.

Price might react when retesting these points later. But remember, they are short-term and lagging.

Visualizing Market Structure:

A series of Fractals can help visualize short-term Higher Highs (HH), Higher Lows (HL), Lower Highs (LH), and Lower Lows (LL), assisting in identifying short-term trend structure.

「Fractals as Short-Term S/R Reference Points」

Level 2: Advanced Plays – Bill Williams System Trading & Breakout Strategies

This is where Fractals were truly designed to shine!

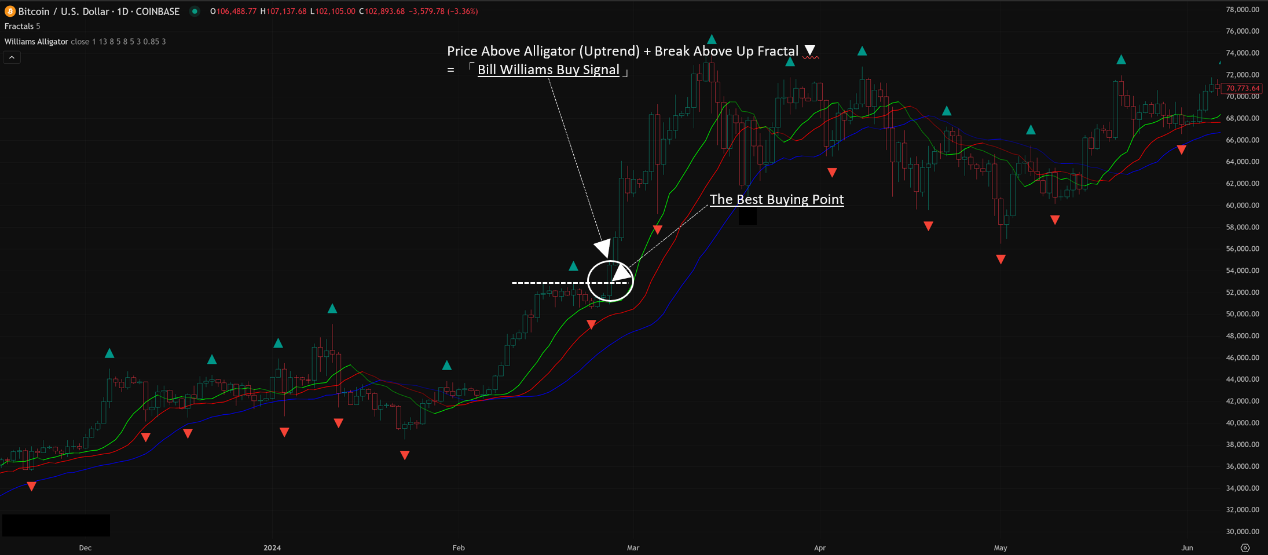

A. Core Use: Trading with the Alligator!

Bill Williams’ Core Idea: Trade with the trend when the market is trending (price outside the Alligator’s mouth), and stay out when the market is ranging (price tangled within the Alligator’s mouth).

Fractals’ Role: Providing the Entry Trigger

Buy Signal:

Price must be above all three Alligator lines (confirming uptrend).

Wait for an Up Fractal ▼ to form.

Place a Buy Stop Order a few ticks/pips above the high of that Up Fractal ▼.

Entry is triggered when price breaks above the high of that Up Fractal ▼.

Sell Signal:

Price must be below all three Alligator lines (confirming downtrend).

Wait for a Down Fractal ▲ to form.

Place a Sell Stop Order a few ticks/pips below the low of that Down Fractal ▲.

Entry is triggered when price breaks below the low of that Down Fractal ▲.

Filtering Rule:

If a Fractal forms while its candle (or the entire 5-bar pattern) is inside the Alligator’s “mouth” (the tangled area of the three lines), that Fractal signal is generally considered invalid and should be ignored! It signifies a non-trending market, which shouldn’t be traded according to Williams.

Effectiveness: This combination uses the Alligator to determine trend direction and tradability, and the Fractal break as the specific execution point for entering with the trend. This is one of the core trading methods of the Bill Williams system.

「Fractals + Alligator Buy Signal Example」

B. As Stop Loss Reference:

Within the Bill Williams system, Fractals are also commonly used for setting initial or trailing stops.

For Longs: Stop loss might be placed below the lower of the last two Down Fractals ▲.

For Shorts: Stop loss might be placed above the higher of the last two Up Fractals ▼.

Logic: Using the last two Fractals provides a buffer zone against being stopped out by minor, single-bar volatility.

C. As General Breakout Confirmation:

Even outside the Alligator system, you can use Fractal breaks as part of a general breakout strategy.

How to Use:

Price breaks above a key resistance level. If it then also breaks above the previous Up Fractal ▼, it adds confirmation.

Price breaks below a key support level. If it then also breaks below the previous Down Fractal ▲, it adds confirmation.

Caution: Without the Alligator filter, this usage might encounter more false signals.

D. Parameter Settings & Timeframes (Parameters & Timeframes for Fractals)

Core Parameter: Periods Left/Right

Default / Bill Williams Standard: 2. This creates the 5-bar pattern (middle + 2 left + 2 right).

How Global Traders Play It?

Vast majority following Bill Williams stick with 2. Because the entire system (Alligator, AO, AC) was designed to work synergistically with the 5-bar Fractal. Changing this parameter might disrupt the system’s internal coordination.

Experimental Adjustments (Very Rare):

Increasing Value (e.g., 3, 4, 5): Significantly reduces the number of Fractals, marking larger turning points. Pro: filters more noise. Con: much laggier signals, might miss early entries. Could be considered on very high timeframes or for capturing only major swings.

Decreasing Value (e.g., 1): Dramatically increases Fractals (creates a 3-bar pattern). Very sensitive but extremely noisy, signal value greatly diminished. Highly discouraged except for maybe very specific, advanced scalping strategies.

Timeframe:

Fractals appear on all timeframes.

Short Timeframes (M1-M15): Extremely numerous Fractals, mostly noise, very low reliability unless used within a highly specific, tested scalping system.

Medium Timeframes (H1-H4): Fractals become more meaningful, reflecting intraday or short-term swing points. H1 or H4 are common primary timeframes for the Bill Williams system.

Long Timeframes (D1, W1): Fractals mark significant daily or weekly highs/lows. Fractal break signals on these timeframes are generally more reliable but lag more significantly.

Consistency: Analyze and apply Fractals on the timeframe consistent with your trading system.

E. Which Combos Are “Hot” & Effective? (Hottest & Effective Setups)

The Absolute Core: Bill Williams System Combo (Alligator + Fractals + AO/AC)

This is what Fractals were primarily designed for! They are part of a system, not a standalone indicator. Trading Fractal breaks outside the Alligator mouth, in the direction of the trend, confirmed by AO/AC momentum, is the classic, tested strategy.

Parameters: Alligator (13,8,5 shifted 8,5,3), Fractals (2 periods left/right), AO (5,34), AC (5,34,5).

Timeframes: H1, H4, D1 commonly used.

Other Combinations Less Effective:

Trading Fractal breaks alone: High risk, many false signals.

Using Fractals as primary S/R: Only short-term reference, not reliable enough alone.

F. Best Parameter Combos? (Optimal Settings Verdict – Stick to the Standard!)

Fractals Indicator:

Highly Recommended / Standard / Best Practice: 2 periods left/right. This is the Bill Williams setting and the most widely accepted and used.

Timeframe:

H1, H4, D1 are common sweet spots for applying the Bill Williams system.

Conclusion: To use Fractals effectively, the best approach is to learn and apply the entire Bill Williams trading system, sticking to the default parameters (Fractals=2) and using them on appropriate timeframes (H1+). Using Fractals in isolation significantly diminishes their intended value.

The Bill Williams Fractals indicator is simple in concept: it objectively marks short-term highs and lows based on a 5-bar rule. Its main value isn’t independent prediction, but rather:

Visually identifying short-term market structure.

Providing objective potential short-term S/R points.

Acting as a crucial entry trigger within the Bill Williams trading system (with the Alligator).

Offering reference points for stop-loss placement.

For young traders interested in learning a complete trading system (especially the Williams method), or those looking for an objective way to mark minor turning points to aid other analysis, Fractals are a fundamental tool worth understanding.

Remember:

Fractals are lagging confirmation indicators (2-bar delay).

They are not standalone buy/sell signals.

The standard parameter is 2 (5-bar rule).

Their strongest use case is with the Alligator (Bill Williams system).

Fractals forming inside the Alligator’s mouth are usually ignored.

Higher timeframe Fractals carry more weight.

Alright! Hope this detailed breakdown of Fractals helps you understand the true purpose of these little arrows! Try loading them up with the Alligator and observe how they work together! See ya next time! Trade with the chaos (theory)!